As we wrap up 2025, the US economy presents a mixed bag: resilient growth on paper, but a grinding reality for millions struggling with everyday costs. While headlines tout steady GDP expansion and low unemployment, the undercurrent is one of frustration—wages lagging behind soaring expenses in housing, food, healthcare, and education. This post dives deep into the state of the US economy, unpacking the affordability challenges that are reshaping American life. We’ll look at the numbers, the causes, and what might lie ahead, all backed by the latest data.

A Snapshot of the US Economy: Steady but Volatile

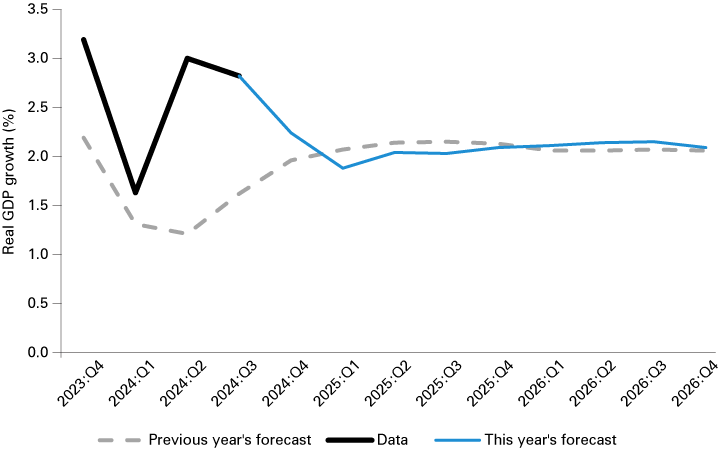

The US economy in 2025 has shown resilience, bouncing back from earlier volatility. According to recent forecasts, real GDP growth is expected to clock in at around 1.9% for the year, with projections for 2026 dipping slightly to 1.8-2.0%. This follows a bumpy ride: Q1 saw a contraction of -0.6%, but Q2 rebounded with 3.8% growth, averaging 1.6% for the first half. By Q4, estimates hover at 1.7-1.9%, reflecting a slowdown in consumer spending but overall stability.

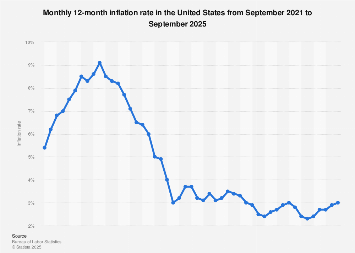

Unemployment remains relatively low, projected to peak at 4.5% in Q4 2025 before easing to 4.2-4.3% in subsequent quarters. This is a far cry from recession fears earlier in the year, but it’s not all rosy—inflation is ticking up, with CPI anticipated at 2.8% for 2025, accelerating to 3.1% in 2026 before moderating. Personal income rose modestly by 0.4% in September, and international trade showed a deficit of -$52.8 billion, underscoring ongoing pressures from global factors.

To visualize this, here’s a chart illustrating US GDP growth trends for 2025:

Despite these metrics, the economy’s “volatility” in 2025—fueled by tariff announcements and government shutdowns—has left many feeling unsteady. Professional forecasters are optimistic for 2026 with 1.9% GDP growth and 2.9% unemployment, but accuracy has been spotty in the past.

The Affordability Crisis: Where It Hurts the Most

Beneath the macro numbers lies a stark affordability crisis affecting broad swaths of the population. A recent Brookings analysis reveals that one-third of the middle class couldn’t afford basic necessities as of 2023, a trend that’s only worsened. Nearly half of Americans report difficulty affording groceries, utilities, healthcare, housing, and transportation. This isn’t just anecdotal; it’s a systemic issue where household prices for essentials have outpaced earnings.

Let’s break it down by key areas:

Housing: The Biggest Barrier

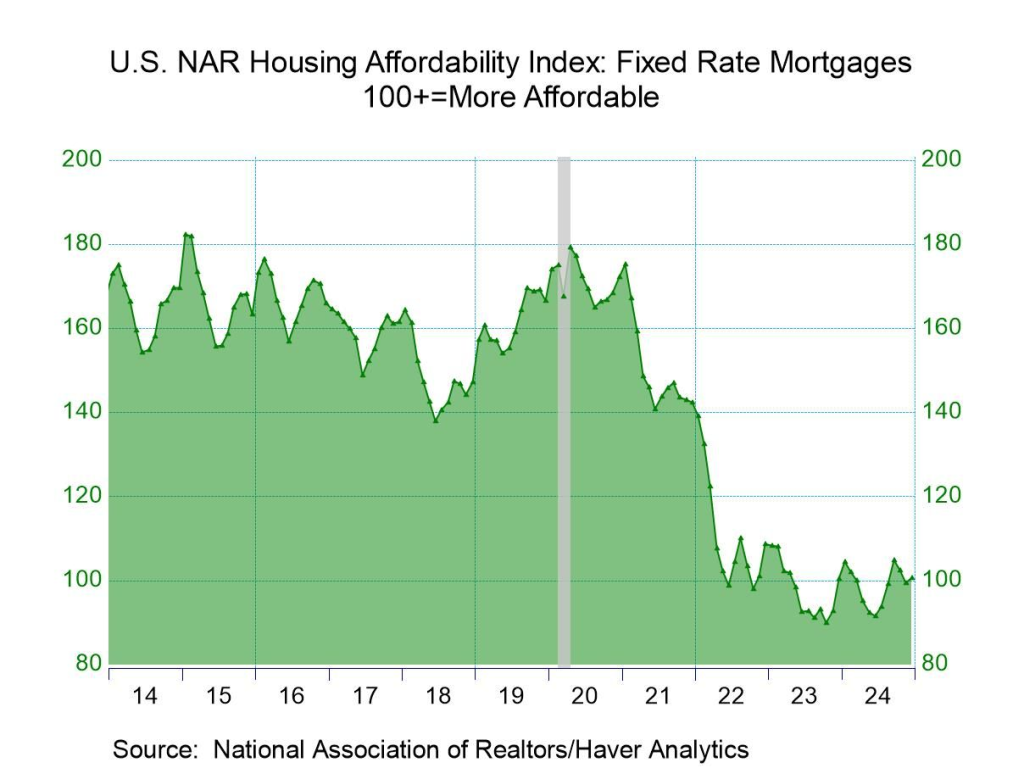

Housing remains the epicenter of the crisis. Affordability has edged up slightly in December, but overall, home prices and rents continue to soar, far outstripping wage gains. In many regions, middle-class families are priced out, with policies exacerbating the shortage. The Urban Institute’s Affordability Tracker highlights how rent and home sales have risen faster than incomes, pushing more into financial strain.

For context, check this chart on the US Housing Affordability Index for 2025:

Food and Groceries: Everyday Pinches

Food prices are set to rise 2.4% in 2025, outpacing the 20-year average. Nearly two-thirds of voters have switched to cheaper options, while inflation’s rebound is making staples less accessible. This compounds the issue for lower- and middle-income households, where inflation has again surpassed wage growth.

Healthcare: Skipping Care to Save

About three in ten have delayed or skipped medical care due to costs. Healthcare expenses have skyrocketed, with policies under the current administration worsening access for many. The Federal Reserve’s report on economic well-being notes that financial comfort levels are below 2021 highs, partly due to these burdens.

Education and Childcare: Long-Term Traps

Childcare and education costs are crippling families, with wages failing to keep pace. This affordability gap is hitting the working class hardest, forcing tough choices like reduced work hours or debt accumulation.

Electricity and utilities add another layer, rounding out a crisis summed up in five brutal charts: food, housing, childcare, health, and energy.

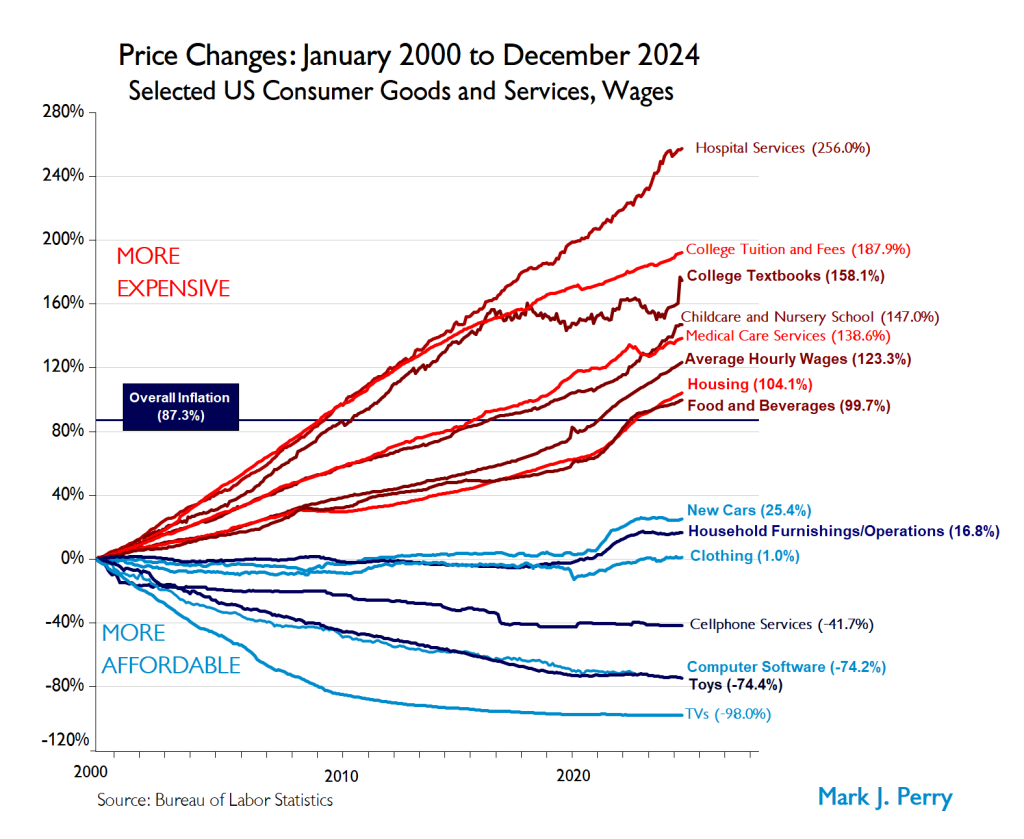

Wages vs. Costs: The Disconnect Deepens

The core of the affordability issue? Wage growth isn’t cutting it. In Q3 2025, wages rose just 0.8%, matching benefit increases but falling short against inflation. Earlier in the year, wages outpaced inflation (4.3% vs. 2.4% in March), but by mid-2025, the trend reversed, with smaller raises fueling discontent. Nearly all workers feel their pay isn’t keeping up with living costs.

Real wages grew 2.1% annually in January but slowed, particularly for non-supervisory roles. Over generations, hourly wage stagnation for the vast majority has been a persistent drag. By June, growth converged at 2.8-3.0% across tiers, but it’s not enough.

This chart highlights the US cost of living versus wages in 2025:

Causes and Contributors: Policies, Inflation, and Inequality

What’s driving this? A mix of rebounding inflation, policy decisions (like tariffs and shutdowns), and structural issues like income inequality. The Atlantic suggests fixing affordability requires tackling broken markets in housing, healthcare, and higher education. Global events and domestic shutdowns haven’t helped, amplifying volatility.

Outlook: Hope or More Hurdles?

Looking to 2026, growth is forecasted at 1.5-1.9%, with inflation moderating to 2.3%. But without addressing affordability head-on, the divide between economic stats and lived experience will widen. Policymakers must prioritize supply-side reforms in housing and healthcare to make progress.

And here’s the inflation trajectory for 2025 to keep an eye on:

Wrapping Up: Time for Real Change

The US economy in 2025 is a tale of two realities: aggregate growth masking individual struggles. As affordability erodes middle-class stability, it’s clear that metrics like GDP alone don’t capture the full picture. For bawlbuster.com readers, this is a call to stay informed and advocate for policies that bridge the gap. What are your thoughts? Drop a comment below.

Stay tuned for more no-holds-barred takes on the economy and beyond.